Enhanced Deduction for Seniors – Frequently Asked Questions (FAQ)

What is the Enhanced Deduction for Seniors?

The Enhanced Deduction for Seniors increases the amount of income you can earn before paying federal income tax. It is available to taxpayers age 65 and older and provides additional relief for seniors living on fixed or modest incomes.

Effective for 2025 through 2028, individuals who are age 65 and older may claim an additional deduction of $6,000. This new deduction is in addition to the current additional standard deduction for seniors under existing law.

Who qualifies for the Enhanced Standard Deduction?

You qualify if:

You are 65 or older at the end of the tax year

You are a U.S. citizen or resident alien

How much is the Enhanced Standard Deduction?

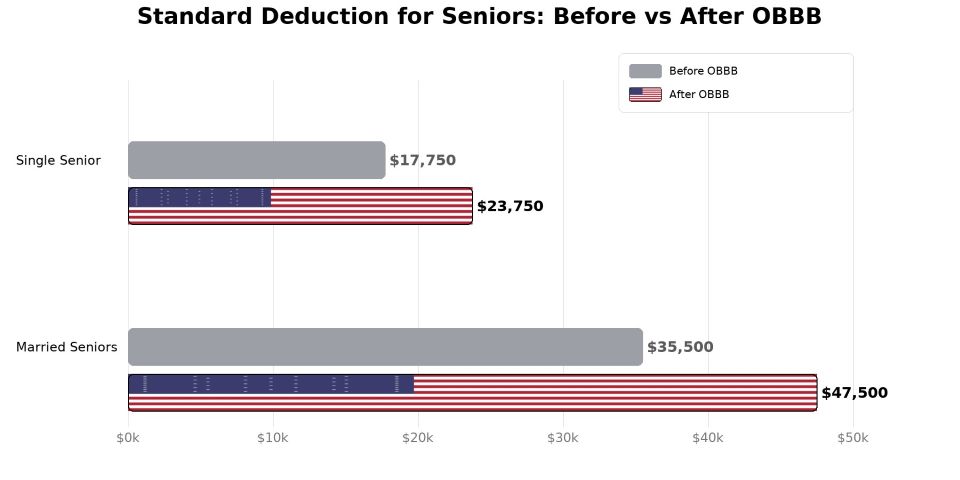

| Filing Status | Original Senior Deduction | OBBB Boost | New Senior Deduction |

|---|---|---|---|

| Single | $17,750 | $6,000 | $23,750 |

| Married (Both) | $35,500 | $12,000 | $47,500 |

How do I claim the Enhanced Standard Deduction?

You do not need to apply separately — it’s built into your tax return if you qualify.

On IRS Form 1040 or 1040-SR, check the box indicating you are 65 or older.

The IRS will automatically add the additional deduction amount.

When does this take effect?

The enhanced deduction is effective for tax years beginning January 1, 2025. Your first opportunity to claim it will be when you file your 2025 federal tax return in early 2026.

How does this affect Social Security income?

According to the Social Security Administration, the average annual benefit for a retired worker is about $24,000.

Up to 85% of that amount (about $20,400) could be taxable under current law.

With the new OBBB senior deduction, nearly all seniors will have enough deduction to fully offset this taxable amount.

Impact:

Single senior: New deduction of $23,750 more than covers taxable average taxable Social Security benefits.

Married filing jointly seniors: New deduction of $47,500 easily covers combined taxable benefits.

How does this help seniors?

More income tax-free: Larger deduction shields more income from taxation.

Simplified filing: Seniors can benefit without itemizing deductions.

Inflation protection: Deduction amounts increase each year with the cost of living.

Where can I get more information or help?

IRS Publication 501 – Standard Deduction: https://www.irs.gov/publications/p501

IRS Form 1040-SR (Senior-Friendly Form): https://www.irs.gov/forms-pubs/about-form-1040-sr

Social Security Administration – Understanding Taxation of Benefits: https://www.ssa.gov/benefits/retirement/planner/taxes.html

Taxpayer Advocate Service – Free Help: https://www.taxpayeradvocate.irs.gov

Need assistance?

Office of Congressman Dan Meuser

Phone: (202) 225-6511 (Washington, DC) or (570) 871-6370 (Pottsville, PA)

In-person assistance available at our district offices — please call ahead for an appointment.